The public sector prepares to face cuts as Gov. Scott Walker develops a plan to reduce the estimated $2- to $3-billion state deficit with a new budget that is to be unveiled at the end of the month. Many assume that his proposal will include severe cuts to funding for higher education, further restricting access to colleges and universities around the state.

Regardless of the potential squeeze, the Madison Area Technical College budget for the current fiscal year called for an increase in funds. This was expected due to record enrollment and the passing of a $133 million referendum to expand the college. Roger Price, vice president of infrastructure, said that no specifics about the state’s budget have been released therefore the school based its budget decisions on the status quo.

“If we speculated with a dooms day approach we wouldn’t do anything,” Price said. “Could, would, may … it’s really tough.”

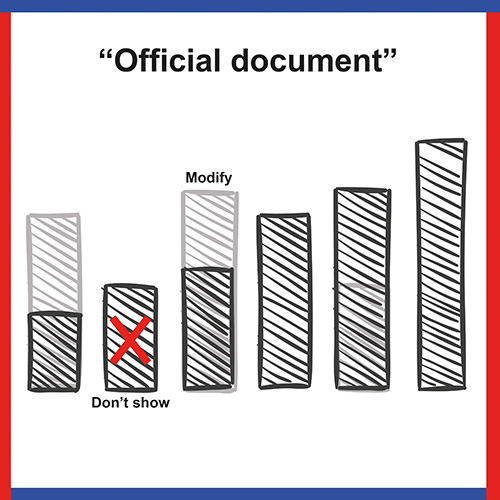

Madison College’s budget is based on funding from three primary sources: the state, property taxes, and tuition. Unlike universities, state funding is actually the smallest contributor, making up about 10 percent of total revenue for the past year. However, increased enrollment, expansion plans, and pressure to help reduce the state’s debt could still mean budget cuts for the college.

Paul Gabriel, executive director of the District Boards Association explained that the Wisconsin Technical College System is aware of the implications of the current political climate. However, the rhetoric that is being tossed around capitol square is vague and conflicting. On one hand, the college is being told it will have more “flexibility” within Walker’s new budget. On the other, it is also being told it will have to play a part in reducing the state deficit.

“We’ve been reading that as both potential significant cuts to state aid as well as limits to local taxing,” Gabriel said. “So that would be of great concern in a time when we are struggling to keep the doors open as wide as possible.”

The college experienced an enrollment increase of more than 11 percent from 2009 to 2010. The number of students attending the college is expected to continue to rise. State funding for the college has remained steady. This means that state dollars spent per capita have decreased in recent years putting pressure on other income sources to make up the difference. This pressure will only increase if a percentage of that funding is cut as a part of Walker’s budget.

The college’s largest source of revenue is its ability to levy district property taxes. This money covers about 62 percent of the total cost of running the college. The levy is limited by a mill rate of 1.5 meaning that by law Madison College cannot impose a tax higher than $1.50 per $1,000 of valuation in our district.

The college called for a nine percent increase in total tax levy for the current fiscal year ending June 30. Due to this, taxes on a single-family home worth $245,424 will increase by $25.29. This increase puts the levy at about 1.3, which is around 14 percent below the legislative limit.

Even with an escalated operational budget, as long as circumstances remain the same, the college is confident that it will stay below the limit over the next several years. However Gabriel said that most people in the capitol believe that there will be an attempt to decrease the levy limit as a part of Walker’s debt reduction scheme.

“Additional restrictions on property taxing is extremely troublesome especially when you look at it in relationship to how much sensitivity there is to raising tuition, and pressure on tuition, and then that there has been flat state funding that really has been eroded by enrollment increases,” Gabriel said.

If additional levy caps are enforced, it is possible that even the current budget could put Madison College over the limit. Insufficient state funding would then fail to make up the difference. If this scenario became reality the college, and its board, would be required to look at options for quickly balancing the budget.

More than 80 percent of costs incurred by the college are due to staffing. According to Price this is first place the administration would look in the case of budget shortfall. This would mean revaluating “efficiencies” in student to teacher ratios and other provided services although Price stresses no such action is being taken at this time. The other option for quickly avoiding a deficit is increasing tuition rates, a decision that would be made by the state board.

“If they cap us … that could have an impact,” Price said. “[The state board] could impact on tuition.”

Depending on what is included in Walker’s budget and when it passes, Price said that resulting tuition increases could be seen as early as the upcoming fall semester.

However, according to Gabriel there has also been a push on capitol square to limit or freeze tuition at a post-secondary level. With nearly unavoidable cuts on the horizon, he said that there has never been a more important time for students to stand up and have their voices heard.

“Let your local officials know that you want to be part of the state’s prosperity and solution,” Gabriel said.

Student representatives are invited to the capitol on Feb. 22 to voice their concerns.

The best way to get involved is by contacting the Madison College Student Senate. Madison College students have a strong selling point according to Gabriel.

Other than reducing the deficit, the top priority of state officials has been jobs. The governor and state legislators know that Madison College plays a vital role in preparing the local work force. It remains to be seen where the college will fall in the fragile balance between the state’s plans for deficit reduction and future job creation.