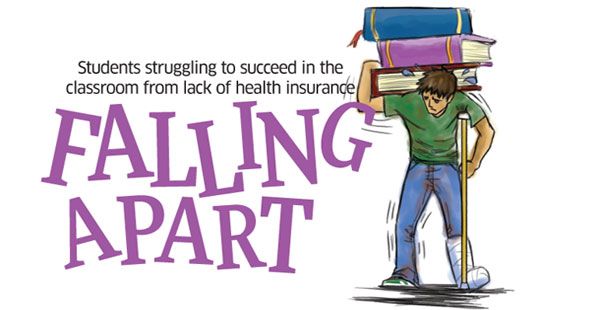

Mary Moore’s favorite part of the day is riding the bus to school. She loves observing the blends of ethnicity in the faces of her fellow riders. However, she knows the trip is fraught with danger.

“As much as I love to ride the bus, it’s one of the most terrifying things I do on a daily basis,” Moore said.

Moore is a diabetic without health insurance. Each time a passenger boards the bus, she retracts her feet in fear remembering how vulnerable this disease has made her feet. An accidental bump or kick could lead to a devastating infection resulting in astronomical doctor bills. With a budget so tight that she regularly chooses between groceries and utility payments, she cannot afford any missteps.

Moore, 47, is among over a million college students nationwide who are uninsured. She, like so many in her situation, often finds that being uninsured has a significant impact on her academic performance. Not only can it restrict mobility, it can also cause significant anxiety that interferes with her focus.

“If students don’t feel well, it’s hard for them to perform well in classes. It’s going to affect the learning process,” said Scot Vesterdahl, Madison College Wellness Center manager.

Madison College does not offer a health insurance plan for students, however Vesterdahl and his colleague, nurse Anna Marie Hoffmann, helped launch the college’s Student Health Services Clinic. The clinic provides first aid services and writes prescriptions for students’ basic health care needs.

A 2008 study by the Government Accountability Office (GAO) found that 1.7 million college students aged 18-23 were uninsured. However, that statistic does not capture the many students in their late twenties and early thirties that community colleges have typically served.

The GAO study also found that older students and students from low-income backgrounds were the most likely to be uninsured. Community colleges have served as points of entry for students above the typical college age and students from low-income backgrounds, often where household breadwinners lack employee-sponsored health insurance. Yet the study revealed that only 29 percent of two-year public colleges offered health insurance plans to their students.

Vesterdahl suspects that, in light of economic downturn, the rise in unemployment has left parents without jobs and insurance. He has also seen a greater number of returning adult students who are unemployed, not having access through an employer plan.

Speaking of her bus ride, Moore flashes a smile of perfectly aligned, white teeth that belie her economic and health circumstances.

“I don’t feel well right now because I don’t have my meds,” she said.

She is unemployed and struggles to treat her diabetes. Her medicine would cost her $600 out of pocket, so she goes without many of them. Diabetes causes her feet to swell, often restricts her mobility and causes blurred vision making it difficult to read the board in class. Pain in her hands makes it difficult for her to type.

“It’s hard to function and perform and think straight for classes and tests if I don’t have my meds,” Moore said.

“What am I going to do between now and when I start my job?” Moore said. “It just leaves people hanging that really need help.”

The Affordable Care Act contains provisions to improve healthcare for students. The legislation marked a historical step during a crossroads on health policy, intending to alleviate the struggles that nearly 50 million Americans face due to being uninsured. These provisions include Medicaid expansion and improvements to students’ access to college health care plans. The most discussed component is the ability to stay on parent’s insurance through age 26. This is no consolation to 19-year-old Madison College student Denise Ugalde Torrijos.

Torrijos was kicked off her mother’s Badgercare plan on her19th birthday in July. Living most of her life without dental insurance, she’s had to squeeze in dental visits during family visits to her native Mexico because her family could not afford them in the US. Recently, she had to get a root canal in the U.S. for $880. She makes payments toward this bill every month.

“I couldn’t eat. I couldn’t take the pain. If I bit something, the (tooth) would feel like it was going to fall out,” Torrijos said.

In the next month, she must complete the root canal procedure by getting a permanent crown. Meanwhile, she scrambles to find a way to pay for the $1,000 procedure. Torrijos has three part-time jobs, and is working 28 hours a week, but she now considers taking on a fourth job or hopes to find a loan to cover the cost. As a full-time student with dreams of being a broadcast journalist, Torrijos worries that a fourth job may cut into her study time. She constantly worries about her growing medical bills.

Brandon McCarey knows the struggleof mounting medical bills when uninsured. A 29-year-old Madison College student, he hopes to someday teach English overseas. Throughout his twenties, he worked a series of low paying customer service jobs, none of which offered health insurance. He is currently unemployed, and living off student loans. McCarey suffers from gout, a recurring condition that inflames the joints of his foot. His untreated flare-ups cause pain when he walks.

“It definitely makes it hard to concentrate or to get to class on time when trying to walk on a sore foot,” McCarey said.

A few years back, the pain landed him in the emergency room.

“I was trying to deal with the pain with Advil, but it wasn’t working,” McCarey said.

That visit – and a subsequent emergency room visit – have left him with over $1,000 in unpaid bills, some of which have been reported to a collections agency. They call almost daily asking for money.

Now in her thirteenth year at Madison College, Nurse Hoffmann has been in close proximity to the struggles of uninsured students. She is now the Senior Program Coordinator for the Truax-based Health Services Center. Hoffmann explained that in tough economic times, cash-strapped families have struggled with the costs of health coverage.

“A lot of parents are having to choose. Some families are having to drop insurance coverage altogether, leaving the entire family uninsured,” Hoffmann said.

She described how going without health coverage has a detrimental effect on school performance. The financial burden of going without health insurance is stressful to many students and forces them to make tough choices of whether to stay in school or take a job to pay bills. She believes that the Student Health Services Center serves a vital purpose.

“We realized that if we are going to retain students and have a high success rate, this was very much going to help us with retention and success,” Hoffman said. She emphasized the need for preventative care and increased mental health services for colleges nationwide.

As the U.S. charts new territory in health care policy, students like Moore, Torrijos and McCarey hang in the balance and hope for better days ahead.

Regardless of differing views on the sources of coverage, educators and students agree that being uninsured burdens the aspirations of those in pursuit of academic and career advancement. Adding to that sentiment, Dane County Health Services Ombudsman Andy Heidt said, “If you want to have the best educated population, you have to have health care as a basic right.”