From the cost of tuition to the daily cost of living, college students are struggling to find ways to make higher education work amidst the backdrop of our current economic reality. This is true particularly for community college students, where affordability is a chief concern for making the college dream possible.

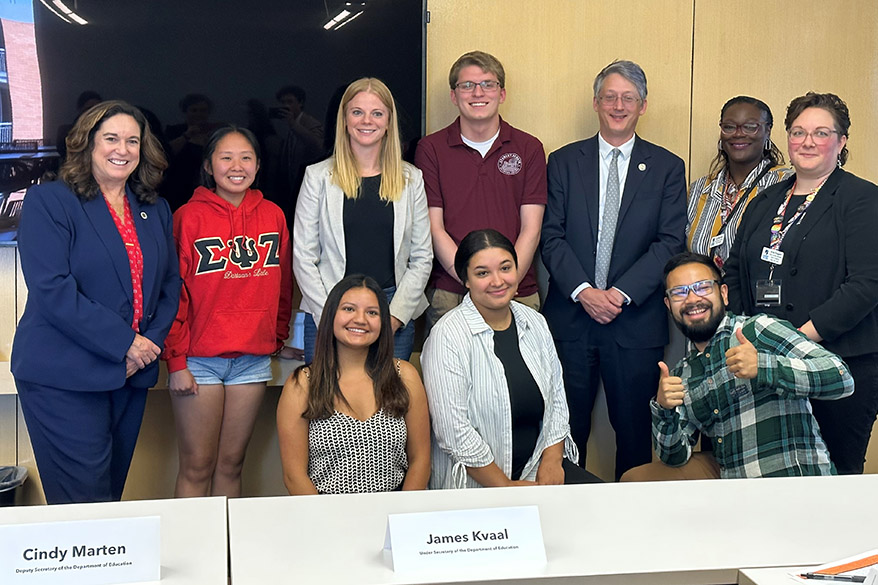

That is why U.S. Under Secretary of Education James Kvaal and Deputy Secretary of Education Cindy Marten invited a delegation of students from Madison College, Edgewood College and UW-Madison to share stories of our experiences paying for college and receiving financial aid.

I was one of five students invited from Madison College to the Student Success Through Applied Research Lab for a roundtable discussion. We used this opportunity to advocate for the expansion of financial aid funds and other benefits programs. Overall, our concerns fell into two categories: Affordability and Accessibility.

Every year in March, the Wisconsin Technical College System sets the tuition rates for all 16 technical colleges for the following year. Historically, those meetings result in a tuition increase, with 1.72% being the average rate of increase over the past five years (2019-2023).

While those increases are fairly modest and below the pace of inflation, the increases are contextualized by the state of the economy. Students feel the burden of perpetually rising tuition rates in tandem with an increased cost of necessities like rent hikes, climbing gas rates, and the seemingly never-ending spike in food prices.

In our conversation, my proposal was to go back to the roots of the college conversation and champion the Free College for All Act. In 2021, as part of his American Families Plan, President Joe Biden pitched two years of free community college, providing tuition-free enrollment and funding for teachers and teacher-training.

And while I personally believe in that ideal, I also recognize that it is not feasible in our current political and economic climate. Back in June, the Supreme Court struck down President Biden’s student loan forgiveness plan in a six to three ruling, ending the hopes of millions of Americans as student loan payments restart in October.

But a simpler proposal to help alleviate the college burden would be to implement zero percent interest student loans. Recently in August, Representative Joe Courtney and other congressional democrats introduced the Student Loan Interest Elimination Act which would refinance the interest rate of all existing Federal student loans to zero percent and cap the maximum interest rate at four percent for all new Federal student loans.

And this bill is just one of many attempts to address the ballooning price tag for student loan interest. Back in 2019, and again in 2021, Florida Senator Marco Rubio introduced the Leveraging Opportunities for Americans Now Act which would cut the interest rate on federal student loans. With some bipartisan support signaled from across the aisle, suddenly student debt relief does not seem so impossible.

The other students in our group focused on access to student financing options. Part of the problem with financial aid is that students do not have the knowledge or awareness to be able to access funds that they are qualified to receive.

When I first started attending Madison College, my goal was to obtain a professional certification as a Certified Fraud Examiner through the Forensic Accounting & Internal Auditing Certificate. It was not until speaking to an advisor about career prospects and sharing my personal story that I learned I qualify for WorkSmart, a program for unemployed and displaced workers. The only reason I can pursue an associate degree is because of the support provided from this program, which I did not know about until after I was already in school for one term.

In addition to lack of knowledge or communication of these programs, sometimes benefits programs work against each other with eligibility requirements.

For instance, to receive SNAP Benefits, half- and full-time students must either be working at least 20 hours a week in paid employment, take care of a child, be in a work study or on-the-job training program, or meet some other specific requirements. These limitations prohibit students from accessing need-based assistance programs, but the reality is that these services would help the average student.

At Madison College, the average age for a student is 29 years old. The reality is that the average student attending school is not a well-off recent high school graduate whose parents are footing the bill. Students can be single working parents, formerly incarcerated individuals, laid off seasonal workers, GED/HSED seekers, or anyone who is returning to school to advance their career.

The bottom line is that we need to increase financial aid options for an expanding definition of “the average student” attending two-year technical colleges.

Because many students, including myself, believe that graduating from Madison College would change our lives for the better. So, my request to the Department of Education is to fund students that are seeking to invest in themselves, starting with community colleges.

Affordability is key to college dream

Interest-free student loans would be a start

Kai Brito, Staff Writer

August 28, 2023

Students pose with Department of Education Officials at the SSTAR Lab. Pictured are, front row, from left: Mercedes Hernandez-Natera, Sinetra Wilson and Kai Brito; back row, from left, Deputy Secretary Cindy Marten, Sheng Ying Vang, Kate Westaby, Casey Konkol, Under Secretary James Kvaal, Lai’Kita Buie, Kris Flugum.

Story continues below advertisement